delayed draw term loan definition

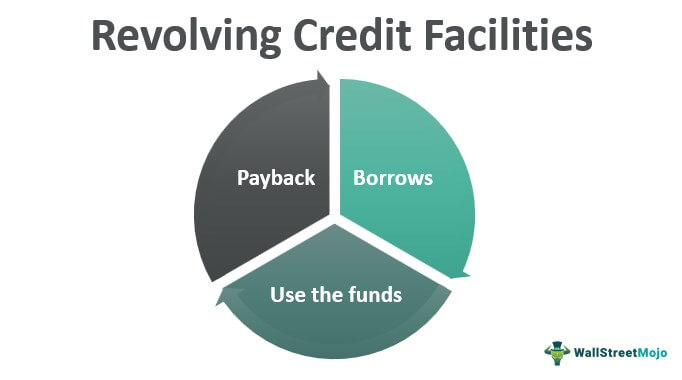

A revolving loan comes with a replenishing feature where the borrower can withdraw amounts and repay to fully utilize the facility again. DDTLs were used in bespoke arrangements by borrowers who wanted to get incremental committed term loan capacity often for future acquisitions or expansions but wanted to delay the incurrence of the additional debt and thus the additional.

Revolving Credit Facility Efinancemanagement

O The definition of Term Loan in Section 101 of the Credit Agreement shall be amended by adding the following sentence at the end thereof.

. Delayed-draw term loans are lender-friendly. DELAYED DRAW TERM LOAN CREDIT AGREEMENT. Delayed Draw Term Loan Maturity Date means the date that is seven years after the Closing Date.

THIS DELAYED DRAW TERM LOAN AGREEMENT this Agreement is entered into as of May 5 2008 among PUBLIC SERVICE COMPANY OF NEW MEXICO a New Mexico corporation as Borrower the Lenders MORGAN STANLEY SENIOR FUNDING INC. A draw is a payment taken from construction loan proceeds made to material suppliers contractors and subcontractors. Delayed Draw Term Loan A Loan that is fully committed on the closing date thereof and is required by its terms to be fully funded in one or more installments on draw dates to occur within three years after the closing date thereof but which once fully funded has the characteristics of a.

And WACHOVIA BANK NATIONAL ASSOCIATION as Co. Drawn DDTL costs mirror term loan spreads. That means the borrower doesnt have to pay them from personal funds while.

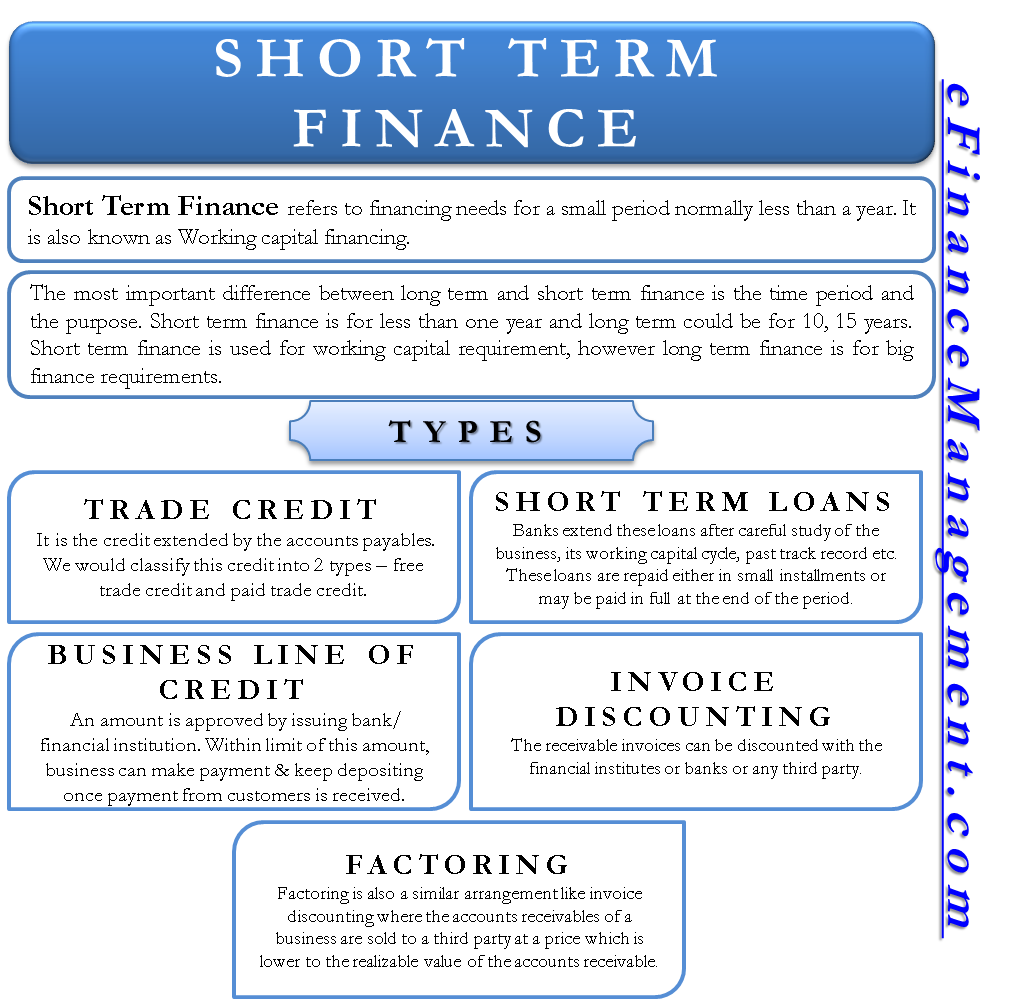

137500000 DELAYED DRAW TERM LOAN FACILITY Table of Contents Page. Refers to the loans that the Lender has agreed to be made available to the Borrower under a Revolving Credit Facility or a Delayed Draw Term Facility that the Borrower has either not drawn or has drawn and repaid. The revolving loans are approved for the short-term usually up to one year.

Is defined in clause c of Section 211. Provided that any Loan as to which no further. Unlike revolvers which are generally unfunded delayed-draw term loans fund over time with the unfunded portion eventually reduced to zero.

THIS FIRST AMENDMENT TO DELAYED DRAW TERM LOAN CREDIT AGREEMENT this Amendment dated as of June 25 2018 and effective as of the Effective Date as hereinafter defined is made and entered into by and among EMPIRE RESORTS INC a. They differ from revolving credits in that once repayments are made they cannot be re-borrowed. Delayed Draw Term Loan means any Loan that is fully committed on the initial funding date of such Loan and is required to be fully funded in one or more installments on draw dates to occur within one year of the initial funding of such Loan but which once such installments have been made has the characteristics of a term loan.

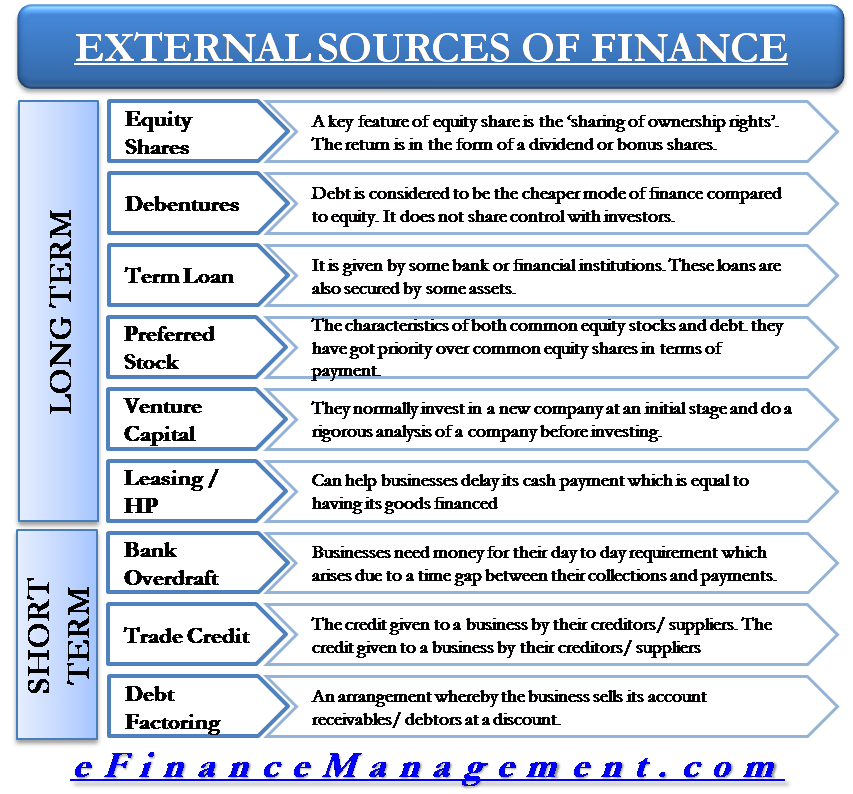

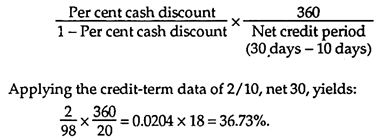

DELAYED DRAW TERM LOAN AGREEMENT. A delayed draw term loan is a special feature in a term loan that stipulates that the borrower can withdraw predefined amounts of the total pre-approved amount of a term loan at contractual times. The lenders approve the term loans once with a maximum credit limit and charge variable interests on them.

Define Delayed Draw Term B-1 Loan. Debt accordions are provisions that allow a borrower to expand the maximum allowed on a credit line or add a. Unless the context requires otherwise i any definition of or reference to any agreement instrument or other document herein shall be construed as referring to such.

FIRST AMENDMENT TO DELAYED DRAW TERM LOAN CREDIT AGREEMENT. Delayed Draw Term Loan A Loan that is fully committed on the closing date thereof and is required by its terms to be fully funded in one or more installments on draw dates to occur within three years after the closing date thereof but which once fully funded has the characteristics of a. Debt Accordions Definition.

ARTICLE I DEFINITIONS AND ACCOUNTING TERMS. After the Delayed Draw Funding Date the Delayed Draw Term Loans shall comprise Term Loans to the extent set forth in Section 201 p The definition of Term Loan Lender in Section 101 of the Credit Agreement shall be. Historically delayed draw term loans DDTLs were generally seen in the middle market non-syndicated world of leveraged loans.

This Credit Agreement dated as of August 31 2012 is among Par Petroleum Corporation a Delaware corporation Borrower the Guarantors party hereto from time to time together with the Borrower each a Credit Party and collectively the Credit Parties the lenders party hereto from time to time the Lenders and. Delayed Draw Term Loan Availability Period means the period from and including the Closing Date to but not including 30 days prior to the Delayed Draw Term Loan Maturity Date or such earlier date on which x Delayed Draw Term Loans have been advanced by the Bank in an amount equal to the Delayed Draw Term Loan Commitment or y the Delayed Draw Term. Provided that if such date is not a Business Day the Delayed Draw Term Loan Maturity Date will be the next succeeding Business Day.

What Is Short Term Financing Definition Sources Advantages And Disadvantages The Investors Book

Revolving Credit Facilities Definition Examples How It Works

Short Term Finance Types Sources Vs Long Term Efinancemanagement

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/DrawDown-72a632110a47496a9fa346b7c63eb557.jpeg)

What Is A Delayed Draw Term Loan Ddtl

What Is Short Term Financing Definition Sources Advantages And Disadvantages The Investors Book

Financing Fees Deferred Capitalized Amortized

External Sources Of Finance Capital

The Benefits Of Long Term Vs Short Term Financing

Short Term Sources Of Finance 2 Major Sources With Merits

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

Financial Statements Definition Types Examples

Types Or Classification Of Bank Term Loan And Features Lopol Org

Delayed Draw Term Loan Ddtl Overview Structure Benefits

/GettyImages-1162280946-fdd66d8f3cd94022885927e27d132192.jpg)